5 Reasons to Explain Why Paper Receipts Are Still Relevant

Paper receipts have been around for some time, and retailers can’t seem to get enough of them. Even in this digital age, they still form the basis for most business transactions. For instance, the Minnesota Pollution Control Agency (MPCA) estimates that America uses about 146,000 tons of thermal paper annually.

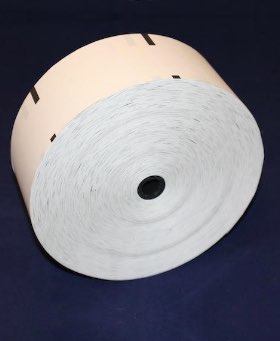

Graphic Tickets & Systems can help fulfill all your point of sale (POS) paper receipts needs. Whether it’s thermal or carbonless paper, these receipts are crucial for the day-to-day running of businesses, and here’s why.

Major Reasons to Consider

Issuing receipts to customers who buy goods is a requirement for your business. It is a way of providing evidence for the concluded business transaction. That aside, here are the top five reasons thermal receipts remain relevant.

Familiar and habitual using of paper receipts

As the saying goes, old habits die hard. People have been using receipts in their current form since the middle ages. Many businesses are reluctant to use paperless receipts in their transactions.

That’s because many customers prefer paper receipts over digital ones. After all, they are easy to use. Unlike digital receipts, you don’t need any technical knowledge to use them.

Security issues

In simple terms, hackers can’t steal any information from receipts. Just like any software gadget, personal details on a digital receipt are susceptible to thieves.

For this reason, retail businesses, such as ATM kiosks, prefer using paper rather than electronic receipts.

More reliable and trustworthy

Another reason receipts are still in use today is because of their reliability. Since information on a receipt is handwritten or typed, it is difficult for anyone to change the details.

Thus, many consider the information contained in receipts more trustworthy and reliable. You should, however, ensure that you choose the right ATM paper or carbon paper that doesn’t fade as fading will erase the crucial information and render the paper useless.

Mistakes

During a business transaction, the chances of calculation errors occurring are prevalent. It can make you overcharge or undercharge a customer.

Catching errors and rectifying them is faster and easier with traditional receipts as you can inspect them on the spot.

Paper receipts are more permanent

Sometimes your phone gets jammed up with a lot of emails prompting you to clear up some space. In so doing, you can accidentally delete digital receipts. To avoid such problems, businesses prefer issuing customers with receipts instead.

Receipts can last for a long time without getting damaged. For example, thermal paper and POS paper can remain legible for more than seven years if kept under ideal conditions.

Benefits of Paper Receipts

Receipts have proved their worth over the years, and that’s because:

No need for a digital device

Anyone can use receipts. All you need is to know how to load printer paper into a compatible printer. Alternatively, you can opt for handwritten receipts if you don’t have a printer. These don’t require any prior expertise to operate.

In the case of paperless receipts, you will need to own a device with wireless connectivity capabilities, such as a smartphone. However, about 25% of the population doesn’t own a smartphone. The number of people that can use digital receipts is thus limited.

They won’t end up in your junk email

At times your email messages might be marked as spam emails for different reasons. If affected, all the electronic messages you send will go to the recipient’s spam folder. Once an email ends up in the junk folder, nobody pays attention to them.

The customer might even end up deleting the digital receipt alongside the spam messages. Or worse, you could send them to the wrong address. You can store receipts safely in one folder to avoid misplacing them.

Uses a reliable and consistent format

When using paper receipts, there is a standardized format for recording the transaction details. You can locate details about the transactions and policy details in a predetermined location on any receipt. The receipt is thus reliable when obtaining information about a specific product.

But when it comes to digital receipts, the style used depends on the smart device, manufacturer, and software used, leading to inconsistencies in the final printing and information provided.

Receipt paper is recyclable

There has been a heated debate about their biodegradability for some time now. The issue was whether to categorize them as recyclable material or not.

According to conserve energy, paper makes up the primary raw material for receipts. Since paper is a biodegradable material, this makes receipts recyclable.

Sure, thermal receipts have other components that make it difficult to recycle. But, separating them from the rest and extracting the unneeded materials means thermal paper is recyclable.

It safeguards your product’s warranty

Some stores will provide their products with a warranty period. This means they will allow you to return the item to the store if it breaks down before a specified period. To return the merchandise, they will need to ascertain that the product belongs to them. Hence, you will use the receipt as proof of purchase.

Since you could mistakenly delete digital receipts with other junk files, it makes sense to use paper receipts when purchasing goods with a warranty. You can store them for much longer in a designated file.

Conclusion

Paper receipts are a necessity for any business enterprise, whether big or small. They have been around for quite some time now and are not going anywhere soon since customers prefer them. Further, you don’t need a smart device to use them.

Visit Graphic Tickets & Services today for a quick look at some of the best thermal paper receipts in the market.