Learn how to make the ATM your most effective advertising vehicle.

Advertising, as in life, is about capitalizing on opportunity. Every day millions of current and prospective customers will interact with an ATM. Most of them will end their transaction without giving the exchange a second thought. Their receipt, if they receive one, will wind up in the wastebasket. Sadly, so will the unrealized revenue of a potential advertiser. We only get so many golden opportunities in life. The same can also be said about business.

Ask any marketing or advertising manager and they’ll tell you: advertising isn’t easy. Consumers can be fickle; their media habits unpredictable. Our society has become so inundated with irrelevant ads that we’ve learned to tune them out. And, while consumer attention wanes, media costs continue to climb, making advertising on a large scale unaffordable for most marketers.

The Advantages of ATM Advertising

Well, advertising doesn’t have to be so challenging. Not for independent ATM deployers (IADs) and financial institutions (FIs), anyway. The ATM provides such marketers with one of the most attractive advertising vehicles available. It’s like an outdoor billboard, a TV, a computer, and a direct mail delivery device all wrapped up in one. The combination of static display and rich interactivity is unmatched by other media. As is the ATM’s proximity to FIs and other retail outlets where the customer’s purchase will be made.

In addition, ATMs offer:

- precise targeting capabilities,

- access to often difficult to reach demographics,

- the customers’ undivided attention when their mind is on money, and

- advertising costs that are a fraction of traditional media.

So, with all of these advantages, why are ATMs such an underutilized avenue for advertising? This white paper will present a case for why ATM advertising should be a part of every FIs media mix, and IADs marketing plan.

Who Uses ATM Advertising

The synergy between ATMs and FIs is too obvious to overlook. It’s the perfect outlet for banks and credit unions to drive brand awareness, or cross-promote pertinent products to a captive audience when banking is top-of-mind.

Often times IADs will secure branding partnerships with FIs, offering the FI ad space on the machine in exchange for a monthly rate and/or for covering the surcharge fee. This can be an advantageous arrangement for both parties as the brand reputation of a trusted institution can increase the transaction rate for the IAD, while the bank or credit union benefits from higher awareness and a broader reach.

But, by no means are the advertising opportunities exclusive to financial institutions. Given the large, and growing network of IADs, ATMs have become a far more common way for people to obtain their money. And their placement within high traffic areas, and proximity to high interest retail stores, broadens the scope of potential advertisers to include almost anybody.

The key for IADs is determining how to package, price, and sell their media space to potential advertising clients and their agencies. This white paper will help make a compelling case from a cost-per-thousand standpoint, which is the standard unit for measuring the relative efficiency of media expenditures.

Types of ATM Advertising

There are many ways to advertise through an ATM. At its most basic level, the device itself can act like a billboard, delivering a message to everyone who passes by. Under this scenario, prospective advertisers, FIs or otherwise, can deliver their message and brand imagery along the sides of an ATM using vinyl wraps, or on display toppers that rise above the machine.

Another option is to use the monitor screen to deliver an ad message at a time when you have a customer’s complete and undivided attention. An advertiser could employ a broad reach strategy by advertising to every person that uses the ATM, or consider a more targeted approach based on demographic data defined by the person’s account information. For instance, a FI may wish to deliver credit card offers to people with certain financial qualifications.

FIs can use ATM advertising to cross-promote products to a captive audience when banking is top-of- mind.

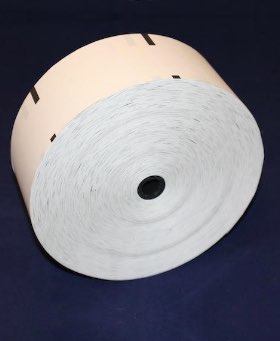

A third option is advertising on the ATM paper receipt. Most customers request a receipt and carry it with them in their wallet or purse for future reference, giving the ad message longevity. Receipt ads also offer the ability to distribute a coupon or promotional offer which can later be redeemed. This feature provides advertisers with a mechanism through which to measure their return on investment, something that is far more difficult to do with other forms of media.

And given the high-quality, four color production capabilities of most print companies, the creative message can be as visually appealing as any postcard or direct mail piece. It’s like giving each ATM user a custom hand-out.

The Efficiencies of ATM Advertising

The cost to advertise on an ATM will depend on the type of ad you want to run and the location of the machine. High traffic sites will draw a higher price, as will locations catering to certain demographics, such as high-net worth areas. IADs should keep these specifics in mind when setting their rates.

Video ads will often have the greatest impact, but are also the most expensive to develop and install, as incremental programming costs are often required to take advantage of some of the more sophisticated targeting techniques.

The most efficient, and arguably most effective, form of ATM advertising is delivered on the thermal paper receipt. This is because receipt paper is essentially a sunk cost for the operator, and the cost of custom printing is nominal. So, the incremental expense to custom print an ad on the back of a receipt is marginal compared to what the operator would already have to pay for stock paper.

On average, the incremental cost to custom print an ad on the back of stock paper can run as low as $6.25 per roll. And each roll can deliver approximately 6,250 advertising impressions. That’s a $1 CPM (cost-per- thousand impressions, the standard unit for measuring media). As you can see below, a $1 CPM is much lower than you’ll find among any of the more traditional media channels.

Advertising CPM* Comparison

- Network TV: $28

- Print: $17

- Cable: $12

- Radio: $10

- Out-Of-Home: $5

- Online: $2

- Custom ATM Receipts: $1

*A CPM is the approximate cost to deliver 1,000 advertising impressions to a specified audience.

The Effectiveness of ATM Advertising

In addition to media efficiency, advertisers will also want to know how effective ATM advertising can be. As with all forms of advertising, effectiveness is hard to quantify without the aid of third party media research firms or some sort of response mechanism.

Custom printed receipt ads are the easiest to measure a response against as the advertiser can supply something tangible for the customer to redeem. According to leading manufacturers, ATM advertisers have achieved response rates of 10 percent and higher for their campaigns, far exceeding the 1-2 percent success rates of most direct mail campaigns, and at little-to-no incremental cost.

Summary

ATM advertising is one of the most effective and cost efficient ways for FIs to deliver a custom ad message to a highly specified target audience. It is also an excellent way for IADs to bring in additional revenue for their network of machines. Please contact us for more information on how to optimize your ATM through advertising and custom printing, or to receive a free quote.

Or shop our ONLINE STORE to find the industry’s most competitively priced thermal paper products.